As a ULD manager, you’ve noticed the increasing demand for cool containers in the air cargo market. And you’re familiar with the multiple providers of cold chain solutions, many offering the latest temperature-controlled technologies. But have you worked out yet whether it’s best to buy or lease your next cool container?

Convincing the boss to pay a chunk of money upfront for new equipment is a big step. And it could be the wrong step if you’re not sure about your facts and figures. On the other hand, leasing could be causing your company unnecessary expense in the long run.

It all rather depends. (Of course.)

There are several factors you need to consider before making that all-important decision, and we’re going to take you through them step by step. We’ll start with the outlook for the cold chain logistics market, then we’ll consider the various business cases for buying and leasing, and we’ll round off with a breakeven analysis.

By the end of this article, you should have a clearer idea of whether it’s better to buy or lease your next cool container.

Ready?

The outlook for the cold chain logistics market in 2021 and beyond

It used to be that only the biggest multinational companies could transport temperature-sensitive cargo from one side of the world to the other and still guarantee its quality to the end consumer. After all, only they had the money and the technology to create a global cold chain.

But times are changing.

Today’s consumers take it for granted that even perishable products can be flown around the globe without their quality being affected. The fish that’s being eaten in a Parisian sushi restaurant today was caught in the seas off Japan only yesterday, yet diners barely pause to think about the effort that went into making that possible.

But it’s not just the rising demand for exotic or out-of-season fresh food that’s driving the growth of the cold chain logistics market (predicted to reach $386 billion by 2024). For starters, pharmaceutical companies are increasingly turning away from chemical-based drugs in favour of biologics and other large-molecule drugs, most of which need to be refrigerated.

Then there’s the fact that many developing countries are improving their healthcare services. As a consequence, many more treatments and drugs are being imported and exported around the world. Today, it’s possible for diabetics in Pakistan and Eritrea to be given life-saving insulin that were manufactured in the USA just five days before.

At the same time, governments are regulating the cold chain logistics market more extensively, which is pushing up standards, encouraging more temperature-controlled innovations, and giving third-party logistics companies opportunities to help smaller manufacturers and retailers to manage perishable goods for air freight.

All this means that the increase in demand for cool containers is not just a blip caused by the sudden rush for COVID-19 vaccines or a fleeting trend for sushi. The need for certified air containers that can maintain a specific temperature range for several days in a variety of conditions is here for the long term.

The business cases for leasing and buying cool containers

Okay, so now we’ve confirmed that adding cool containers to your fleet is a sensible move, there are a number of factors you need to consider before you decide to buy or lease.

The business case for leasing cool containers:

- You don’t have the capital to invest in cool containers. Leasing gives you the opportunity to expand your business and spread the cost over a number of years.

- You don’t have enough regular business to invest in a permanent solution or you can’t predict long-term demand with confidence. Short-term leasing allows you to respond to a temporary surge in demand and overcome unforeseen ULD shortages.

- You’re not able to fully handle a fleet yourself and you’d like to have access to management, maintenance, repair and assembly services.

- Your customers require you to use equipment that is only offered as a leasing solution (some shippers make this a requirement).

Leased ULDs often come with an all-in-one package, for which you pay a fixed price for a set number of days. This price includes the cost of preparation, pick up and return as well as the lease itself.

Most leasing companies have a global network of service locations, so you don’t usually have to return the leased ULD to where you picked it up from. This is extremely handy. However, even the largest networks cannot provide a pick-up and return service at every airport, so you must still be prepared to relocate some of your empty containers.

Another thing to bear in mind are the obligations imposed by the leasing company. Containers must not be damaged while in your care, and they must be returned to the agreed locations. If these conditions are not met, you pay a surcharge that is often significantly higher than the actual cost of the lease.

The business case for buying cool containers:

- You have a solid, long-term flow of cold chain products, and you’re confident that demand for your business will continue for the foreseeable.

- You’d like to have total ownership of your assets because you want more flexibility in how and when you use them, and you don’t want to be bound to the terms and conditions of a leasing agreement.

- You have a mature cold chain operation already in place or you have the resources to set this up. This includes access to cold warehouses and material handling systems that cut the time perishable goods spend in warehouses and in transit.

- You want to provide a cool container leasing service yourself.

Owning ULDs obviously means having to prepare, store and manage your container fleet yourself. You also need to have access to a certified repair facility when containers are damaged. However, there are significant cost savings in the long-term that may well justify this additional responsibility.

Let’s take a closer look at how we arrive at those cost savings.

Finding the breakeven point between buying and leasing

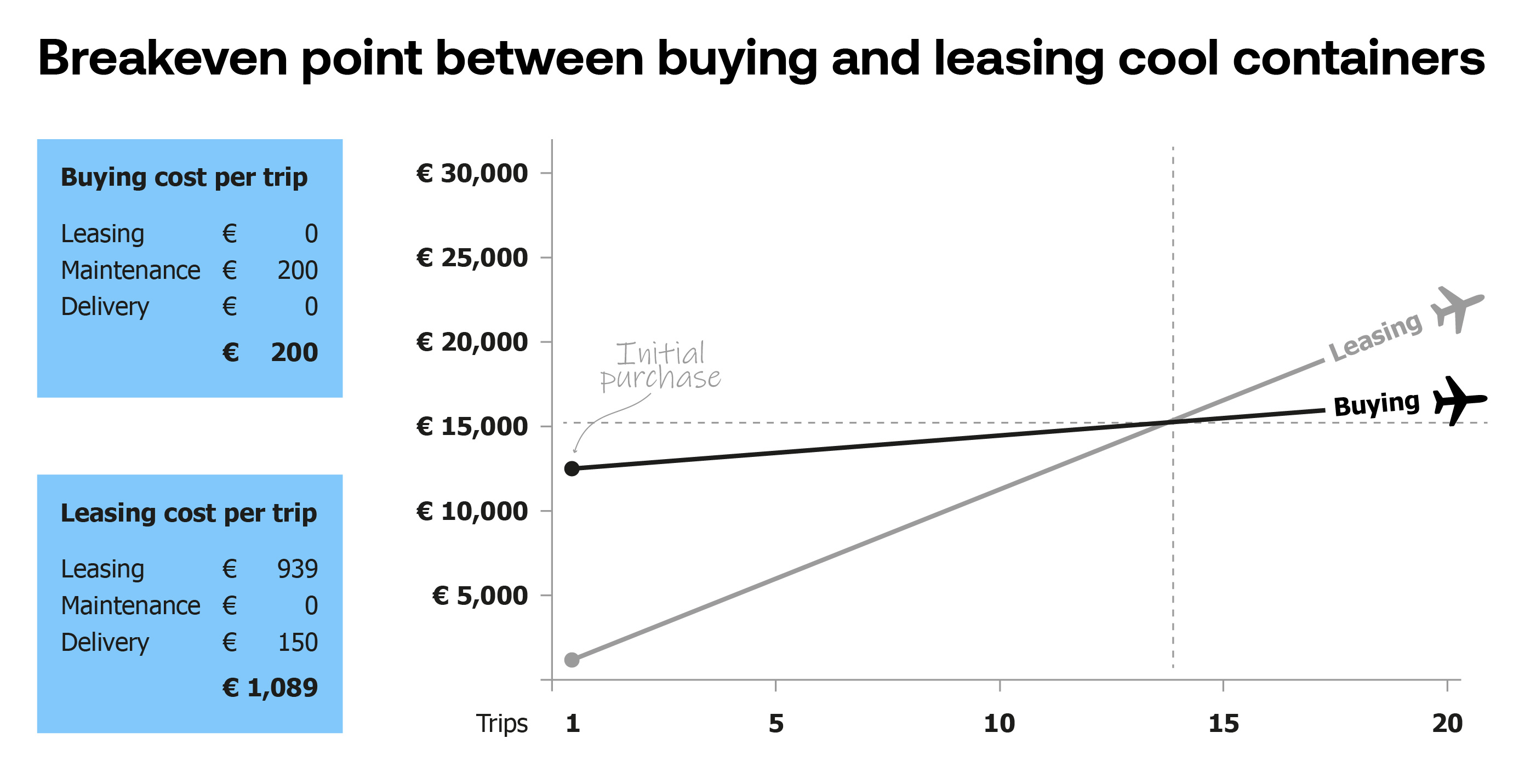

To compare the cost of buying a cool container with leasing a cool container, we’ll use a simple example.

A small airline uses RKN cool containers to carry out on average 10 shipments of perishable products a year. Each shipment is a round trip taking no more than five days. Unfortunately, the nearest ULD or air cargo container leasing company has no presence at the airport of origin. Therefore, if the airline decides to lease the cool container, it must pick it up from another airport 200km away.

Our financial comparison below takes into consideration the lease cost, the purchase price, the transportation costs, the cost of cooling, the battery costs and the average repair costs. We’ll assume that the RKNs are never damaged so surcharges are not included in the leasing solution.

Disclaimer: calculations based on figures available at service providers websites. Average maintenance is estimated on € 200. Delivery is based on situation where service provider is not located on the airport of origin. Initial purchase price based on substantial amount of RKN containers ordered

In this particular situation, the breakeven point is reached after just 15 shipments. In other words, if the airline bought rather than leased its cool container, it would start saving money after 18 months (even quicker than that if the containers were damaged in any way and surcharges are imposed).

Since the average lifespan of an RKN cool container is between eight and ten years, savings can add up significantly over the entire lifetime of the asset. Of course, entering your own variables may well produce a different result. But this example does serve as a useful illustration.

What’s the conclusion?

When deciding to buy or lease a cool container, you need to consider the pros and cons of both options from a business perspective. Each company is different. However, the current market and its outlook strongly suggest that—if you have the business case for it—buying is the most cost-effective option in the long term.

Finally, we used a simple calculation above to show you how to find the breakeven point. For many fleet managers, comparing actual and projected costs is likely to be more complicated. If you’d like to find the breakeven point for your company but you’re not sure how to tackle it, we’d love to help. Just send an email to info@vrr.aero.

A handy tool to help you calculate the breakeven point

Struggling to calculate the breakeven point? Our calculation tool makes your decision-making process a whole lot easier. It determines the breakeven point between leasing and buying based on conditions that are unique to you. All you have to do is enter a few variables, and our tool will do the rest. Check it out. It’s absolutely free.

%20resize%20web.jpg)