The global pharmaceutical cold chain logistics industry isn’t like any other logistics market. It’s huge, it’s complex, and much of the cargo is life-saving. Literally.

Valued this year at around $73bn, the industry of cold chain logistics requires harmonised handling procedures, specific transport equipment, and a high degree of regulatory compliance. What’s more, it’s continuing to grow.

The increased demand for medicines and PPE due to COVID-19 is a key factor, of course. But it’s not just the current crisis that is driving market growth.

There’s the rising demand for all kinds of drugs that help combat an increasing number of chronic and lifestyle-related diseases. Then there’s the mounting pressure for Over-the-Counter medicines such as vitamins, minerals, cough and cold drugs, and gastrointestinal and dermatology products.

As our list of common and not-so-common health problems grows, so do our expectations for cures and treatments. And the pharmaceutical industry is rising to the challenge by providing us with an ever-wider array of pharmaceuticals, many of them requiring temperature-controlled transportation under proper cold chain management.

With so many pharmaceuticals criss-crossing the globe, and the hope that soon we’ll have a COVID-19 vaccine to distribute, let’s take a closer look at this interesting logistics sector, in particular the pharmaceutical cold chain solutions.

The staggering size of the pharmaceutical trade

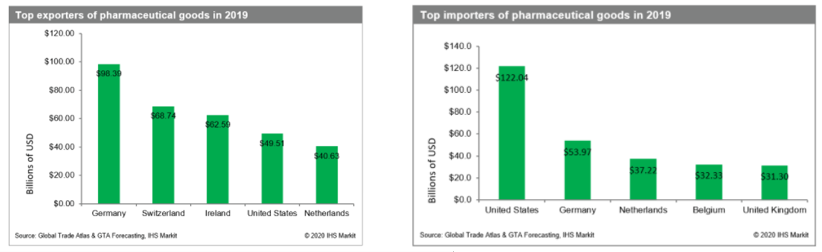

Pharmaceuticals are imported and exported around the world on a massive scale. As such, it is an immensely important global sector. In 2019, it was worth over $1.25tn, and that number is expected to grow to $1.6tn by 2024. Fuelling this growth are aging populations and new drugs to treat rare and specialty diseases.

North America and Europe are responsible for the lion share of this global revenue. However, Asia is catching up fast. India and China are particularly significant when it comes to the supply of raw materials and Active Pharmaceutical Ingredients (APIs).

Of course, the recent coronavirus pandemic has shone a spotlight on the increasingly interdependent nature of the pharmaceutical industry and the wider health industry. When normal, non pharmaceutical trade lanes were disrupted as countries went into lockdown and imposed quarantine and other protective measures, many of us suddenly realised how reliant we are on international trade to get our medicines or the ingredients for our medicines.

Types of pharmaceuticals transported globally

The pharmaceutical industry transports a vast range of products around the world every single day, including:

• Biologics (e.g. vaccines, blood, allergens, genes and tissues)

• Prescribed drugs (e.g. opioids, benzodiazepines and stimulants)

• Over-the-Counter medicines (e.g. vitamins, minerals, supplements, common cough and cold drugs, and dermatology products)

• Raw materials and bulk pharmaceuticals (e.g. chemical compounds and APIs)

Pharmaceuticals come in three main forms: liquid (spirits, elixirs and tinctures), ointments (creams, pastes and jellies), and solids (pills, tablets, lozenges and suppositories). Whatever form they come in, they must always be labelled and packaged correctly and securely. Many pharmaceuticals can be damaged from temperature changes, sunlight, humidity and so on. Biological products especially require careful handling. This is where cold chain management comes in.

How are pharmaceuticals transported long distance?

If needed urgently, ordered on a just-in-time basis, or have a high-enough value, pharmaceuticals go as air freight. However, most that are moved long distance go as ocean freight.

There will always be situations that require pharmaceuticals quickly, but it seems that many manufacturers are content to deliver most of their products by sea. And it’s a trend that seems to be growing in cold logistics.

According to the International Air Transport Organisation (IATA), air cargo share of global pharma transport declined from 17% in 2000 to 11% in 2013. In 2018, 0.5 million tonnes of pharmaceutical goods were flown while 3.5 million tonnes were shipped.

But why is the air cargo share declining?

Cost is one reason. Ocean transport is usually much cheaper than air transport. But there’s also the issue of temperature excursions in cold logistics. The World Health Organisation defines a temperature excursion as an “event in which a Time Temperature Sensitive Pharmaceutical Product (TTSPP) is exposed to temperatures outside the range(s) prescribed for storage and/or transport.”

Unfortunately, air freight has historically been subject to far more temperature excursions than road or ocean freight. The reasons are many, and the air cargo industry is working hard to address this issue with the cold supply chain. Meanwhile, if time is not a critical factor, ocean freight is seen by many as the safer option for temperature-sensitive pharmaceuticals in the cold chain logistics.

The importance of cold chain logistics to the pharmaceutical industry

The issue of temperature excursions is crucial to pharmaceutical companies since many of their products require temperature-controlled storage and distribution to maintain their efficacy and other properties.

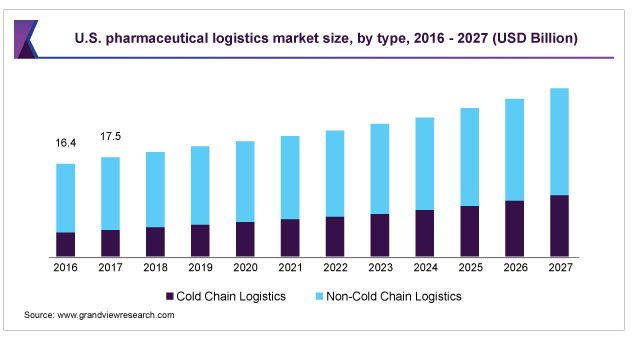

In terms of value, cold chain logistics accounted for more than 26% of the pharmaceutical industryin 2019. That share is likely to increase. First, there is growing demand for temperature-controlled products with the development of so many advanced therapies that are derived from human cells. These biologic materials are super sensitive to temperature change.

Second, cold chain management is making great strides in temperature sensors, data loggers, telematics and cloud computing solutions, all of which enable track and trace and real-time remote temperature monitoring—safety aspects that are crucial to the pharmaceutical industry.

The challenge of transporting temperature-sensitive pharmaceuticals

The importance of keeping temperature-sensitive pharmaceuticals within their prescribed ranges throughout their journey (including storage at their final destination) cannot be overstated. Pharmaceutical manufacturers know this because it is their responsibility to account for a product’s quality until its final use.

Pharmaceuticals sensitive to high temperatures can become less effective, and in some cases even toxic, while those sensitive to low temperatures usually lose their therapeutic properties if frozen. Either way, not transporting or storing pharmaceuticals within their prescribed temperature range can have a serious effect on the health of individuals, in some cases it can even be life-threatening.

To preserve the efficacy of their products, pharmaceutical companies and manufacturers ship a significant proportion of their cargo as either chilled or frozen. In 2015, around 31% of pharmaceuticals in the cold chain logistics were transported as chilled and around 17% of pharmaceuticals were transported as frozen.

Chilled: A chilled environment is in the +2°C to +8°C range. Products requiring a chilled environment must not freeze or become too warm in transit, otherwise their potency is affected. Ventolin (an aid to breathing) is an example of a pharmaceutical carried at chilled temperatures.

Frozen: Temperatures colder than minus 15°C are mandatory for some pharmaceutical trade. It can be difficult to detect by eye if a product has thawed and then re-frozen, so these products may have to be subject to laboratory assessment before being used. Organs and tissues are usually moved as frozen cargo.

Regulating a highly specialised cold supply chain

In the pharmaceutical industry, maintaining a safe and secure cold supply chain is essential, which presents significant challenges to the logistics industry. Consequently, the supply chain is highly regulated.

In recent years, partly as a result of the huge increase in pharmaceuticals that are sensitive to temperature change, there’s been a clear shift towards standardising global transportation regulations for healthcare-related products.

In the USA, the Food and Drug Administration (FDA) sets outs its standards for the manufacture, storage and distribution of pharmaceutical and food products in the Current Good Manufacturing Practices (CGMP). It covers all the steps in the supply chain, from transport operations, labelling and packaging to personnel training and record-keeping.

Likewise, the EU has published the Good Distribution Practice of Medicinal Products for Human Use (GDP). The aim of compliance is to maintain the quality and the integrity of medicinal products. Like its USA equivalent, it covers aspects such as quality management systems, personnel, premises and equipment, documentation, and qualification of suppliers and customers

Governments are not the only organisations introducing regulations.

The International Air Transport Association (IATA) sets out its standards for transporting pharmaceutical products by air in its comprehensive Temperature Control Regulations (TCR). It also requires a Time and Temperature Sensitive Label to be affixed to all shipments booked as time and temperature sensitive cargo. And, since 2013, airlines and ground-handling agents must use IATA’s Standard Acceptance Checklist for time and temperature sensitive shipments to ensure that essential control activities are carried out.

The effect of regulating every step, from manufacture all the way through to dispensing, to prevent cross-contamination, product degradation, and even the infiltration of counterfeit products, is encouraging logistic companies to specialise in shipping pharmaceuticals, medical devices and healthcare-related products. These companies have a detailed understanding of the regulatory and logistical requirements of shipping such products door-to-door, helping manufacturers guarantee quality and efficacy.

Cool containers for your cold supply chain?

Did you know VRR is the only company selling cool containers? Is it better for your company to buy or lease an air-cargo cool container? It’s quick and easy to estimate with our free online Buy vs. Lease Calculator.

Temperature-sensitive containers for sea and air

The increasing regulatory environment, the proliferation of advanced temperature-sensitive therapeutics, and the growth in specialised logistic companies is also promoting the production of a wide range of temperature-controlled containers.

Pharmaceutical companies and manufacturers that ship their chilled or frozen products by sea often use reefer containers. Reefer is short for refrigerated container, and they do indeed work on a similar basis to an oversize fridge.

Reefers are designed to maintain rather than reduce the product’s pre-cooled cargo temperature. They do this by distributing chilled air through T-shaped decking on the floor. This produces a consistent and uniform flow of air throughout the container.

Increasingly, reefers are offering enhanced capabilities such as back-up generators and controlled-atmosphere technology.

Manufacturers that ship their cargo by air use cool containers. These temperature-controlled air cargo containers come in a variety of shapes and sizes, depending on cargo and aircraft compatibility, whatever the cold supply chain of a pharmaceutical product require. The RKN and the RAP for example, are perfect for the Boeing 777 and the Airbus A300, among other things.

There are two types of cool containers for cold chain shipping with air cargo on the market: passive and active. Passive cool containers prevent fluctuations in the cargo’s temperature but do not actively control the temperature. They rely on insulated panels and a source of cold such as wet ice, gel packs, dry ice or liquid nitrogen.

Active cool containers, on the other hand, have a system that monitors and controls the temperature level automatically. These systems are made up of sensors, a control unit, ventilators, an air duct and a data log. The data log measures the actual temperature inside the container throughout the entire journey, which helps to guarantee temperature stability.

Which one you choose depends largely on a variety of internal and external factors in the cold supply chain.

Looking to the near future

There’s no doubt that the pharmaceutical cold supply chain is of global importance. Every day it delivers millions of pharmaceuticals around the world, helping to cure illnesses and prevent diseases.

And the industry’s importance will become even more immediate when a vaccine for COVID-19 is finally produced. We don’t know when that will be, but—when it does (and we hope it’s very soon)—we can be confident that the procedures and equipment to deliver the vaccine are already in place.

If you’d like to know more about our range of cool containers for chilled (+2°C to +8°C) or frozen transportation (<-18°C), please contact us. We’d be happy to advise.

%20resize%20web.jpg)