The air cargo industry has been playing a crucial role during the coronavirus pandemic.

But it hasn’t been easy.

As global demand for PPE (personal protective equipment such as masks and gloves) and essential medical supplies shot up, air cargo capacity plummeted with the grounding of thousands of passenger planes—planes that under normal circumstances carry around 50% of the world’s air cargo in their lower-decks.

The loss of belly cargo capacity has

been a huge problem for logistic companies and freight forwarders the world over. However, the aviation industry has responded with speed and ingenuity.c

But now another problem is looming.

Stock levels of Unit Load Devices (ULDs) are being put under increasing pressure. And that is creating an enormous headache for ULD fleet managers.

Industry-wide revenue passenger kilometres (RPKs) shrank by 94.3% year-on-year in April, the largest contraction in recent history amidst large-scale lockdowns linked to COVID-19. The decline was broad-based across all regions.

First China, then the rest of the world

The impact of COVID-19 on the air cargo industry was first felt in China, the epicentre of the virus. Air freight stopped almost overnight, and the disruption to global supply chains was severe. To add to the confusion, there were suddenly more air cargo flights going West-East than East-West as China increased its imports of PPE and reduced its exports to the rest of the world.

China started to recover swiftly. By the end of February, about 70% of China’s large industry had restarted operations. However, the pandemic was spreading fast to the rest of the world. In April, global passenger flights (which carry freight as belly cargo) fell by around 95%; in May, global air freight rates soared to their highest level.

A mixed outlook for cargo carriers

Since the aviation industry’s low-point in April, the outlook has improved somewhat for cargo carriers:

- Passenger airlines have been converting grounded passenger planes into combi- or all-cargo planes, pulling old planes out of retirement, expanding their cargo fleets, and offering charter services, which has helped ease the cargo capacity crunch.

- Many civil aviation authorities have also helped provide additional cargo capacity by temporarily approving the use of overhead bins, under-seat areas, and storage closets for lightweight cargo and by allowing cargo to be carried on the seats, subject to conditions.

- Demand for urgent medical supplies and PPE is now giving way to pre-planned ordering, leading to a 60% fall in air rates between China to the US and Europe from their high-point in mid-May.

Yet the supply chain is still having t

o contend with continued restrictions on air travel and bottlenecks at major airport hubs. At some airports, it can take up to two weeks to clear freight through customs. In fact, the capacity shortage is still so critical that the Airfreight Forwarders Association is imploring airlines to offer freight-only flights in addition to their ad hoc charters.

Reduced feeder flights, fewer available routes, increased cargo inspections, crew quarantines, reduced staffing levels and temporary trade embargoes have created huge bottlenecks at air cargo handling centres.

Major disruption to traditional global trade routes

One of the biggest disrupters to the air cargo industry is the swift and constant fluctuation in the direction of traditional global trade routes.

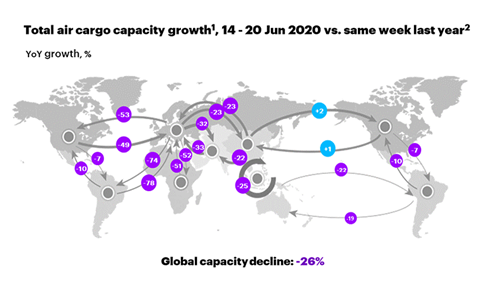

Huge regional variations in cargo capacity are emerging. The latest year-on-year figures for total air cargo capacity show that flows from North America to Latin America decreased by 7%, trans-Pacific eastbound grew by 2%, Europe to Asia capacity declined by 23% and Europe to Latin America capacity declined by a staggering 75%.

Trade route fluctuations are bound to continue for some time as global events unfold at different rates accor

ding to how each country responds to the coronavirus. It’s hoped, of course, that manufacturers will gradually get back to full capacity and e-commerce will eventually return to typical levels, restoring the customary flow of goods around the world.

On the other hand, no one knows yet the long-term effect of the pandemic on the global supply chain. Trade tensions between China and the USA, a potential second wave of COVID-19, the reluctance of governments and businesses to rely heavily on far-flung suppliers: each and any of these could prevent a return to ‘normal’ any time soon.

Unfortunately, none of this helps the global ULD imbalance.

Intensifying the global imbalance in ULDs

ULDs, or air cargo containers and pallets, are used on countless different trade lanes to protect cargo and keep planes safe. But there’s always been a problem of having the right number of ULDs in the right place at the right time. There’s often an overstock in one

part of the world (usually the USA and Europe) and a shortage somewhere else (usually Asia).

Neither situation is optimal: an excess of ULDs ties up cashflow, and a lack of ULDs put pressure on delivery times. But what was already a problem for the air cargo industry has been made much worse by the pandemic.

Airline operators are now saying that, with the grounding of thousands of planes, thousands of ULDs have also been grounded. Storage space at airports, which has always been limited, is now so scarce that some operators are considering storing their ULDs in the grounded aircraft, something unthinkable just a few months ago.

Skypooling, a sharing platform for ULDs, is seeing the same problem from a different perspective. It has reported a significant increase in the quantities of offered and demanded ULDs, pushing up values by almost 40% compared to the beginning of the year. So severe is the pressure on ULD stock levels that Skypooling is now offering their emergency inquiry feature, usually available to premium users only, to all members free of charge.

Helping restore balance with collapsible air cargo containers

At VRR, we naturally keep an eye on developments in the air cargo industry. While some ULD manufacturers have opted to provide temporary solutions to carriers (which is great), we have made a conscious decision to focus on providing long-term solutions.

Our collapsible ULDs, which we’ve been developing for several years now, is designed to help airlines and operators cut costs and operate much more efficiently. These smaller, foldable containers carry the same volume of cargo as standard containers but enable leasing companies and transport integrators to manage large container fleets much more efficiently. They can stack them up to seven high on lower-deck positions for the return journey or at an airport storage facility.

We may not be able to do much about fluctuating trade flows, but we can certainly make a difference to the lives of ULD fleet managers—and help address the global imbalance of ULDs at the same time.